Grundlagen der Ertragswertberechnung

Zeitwert des Geldes und Risikoberücksichtigung

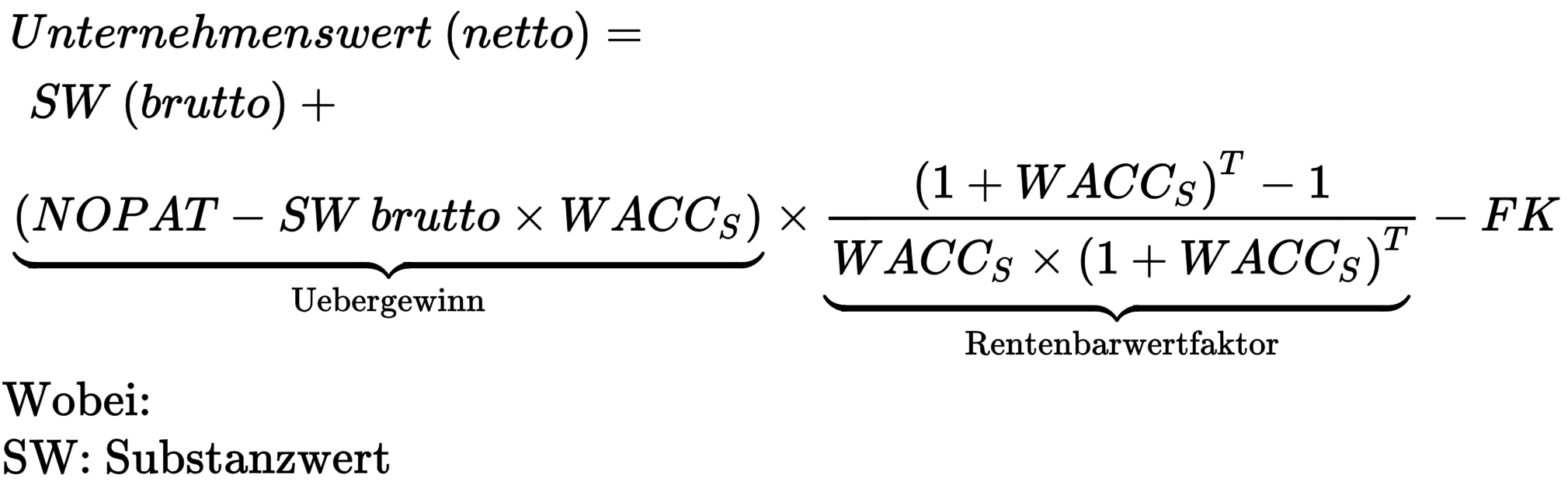

Die zukunftsbasierten Ertragswertmethoden wie die DCF-Berechnung gründen auf der Methodik, dass erwartete Ertragsströme (Cash Flows), die den Firmeneigentümern in der Zukunft zufliessen, auf den Zeitpunkt der Unternehmensbewertung angepasst werden. Das zugrundeliegende Argument ist der Zeitwert des Geldes. Dieser besagt, dass ein Franken heute mehr wert ist als ein Franken morgen, da jedes Individuum eine positive Zeitpräferenz hat. An den Finanzmärkten wird das durch die Anwendung eines bestimmten Zinssatzes (dem risikolosen Marktzinssatz) berücksichtigt. Neben dem Zeitwert des Geldes wird der Faktor Unsicherheit miteinbezogen: Die Zukunft und somit die Rahmenbedingung der unternehmerischen Tätigkeit können nicht vorausgesagt werden - sie sind unsicher. Zukünftige Erträge unterliegen potenziellen Schwankungen. Dies wird als sogenannte Volatilität bezeichnet. Je höher die erwarteten Schwankungen sind, desto höher ist die Unsicherheit und damit auch der Kapitalkostensatz, mit dem die zeitlich verzögert anfallenden Ertragsströme abdiskontiert, sprich auf den Bewertungszeitpunkt überführt, werden.

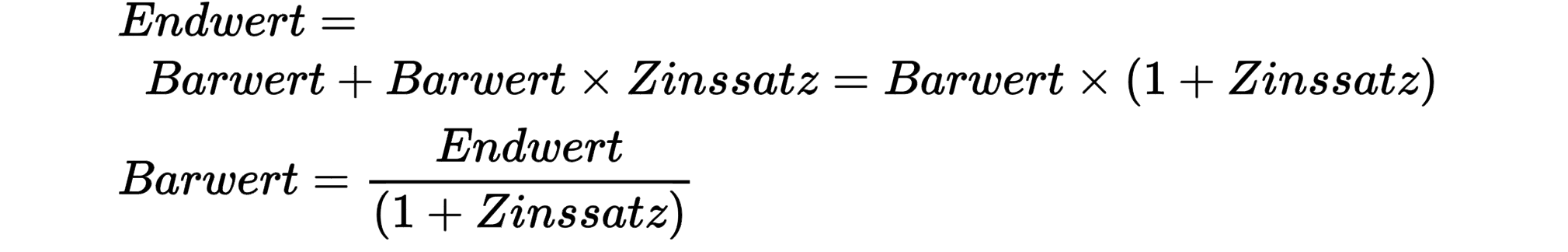

Der Kapitalkostensatz ist ein Zinssatz, der sowohl die erwähnte zeitliche Komponente als auch die dargelegte Unsicherheit berücksichtigt. Mit Abdiskontieren ist konkret gemeint, dass ein zukünftiger Ertragsstrom (Endwert) durch den Term (1+Zinssatz) t dividiert wird, um den heutigen Wert des Ertragsstroms (Barwert) zu erhalten (t steht dabei für die Zeitperiode). Die Ertragsströme können Gewinne oder Geldflüsse (Cash Flows) sein, die dem Firmeninhaber am Ende eines Geschäftsjahres zufliessen.