Due Diligence Checkliste

Die Due Diligence hat mehrere Funktionen. In erster Linie vermindert sie die Informationsasymmetrie zwischen Käufer und Verkäufer und liefert die für einen qualifizierten Kaufentscheid notwendigen Informationen. Neben dieser Informationsfunktion kommt der Due Diligence auch eine Bewertungsfunktion zu, da die massgebenden Parameter für die Preisfestsetzung anhand der zur Verfügung gestellten Unterlagen vom potenziellen Käufer plausibilisiert werden. Zu guter Letzt hat die Due Diligence teilweise eine Exkulpationsfunktion, sofern die Berater des Käufers den Kaufentscheid sowie die vereinbarten Kaufbedingungen gegenüber der Käuferschaft rechtfertigen und sorgfältiges Handeln dokumentieren müssen.

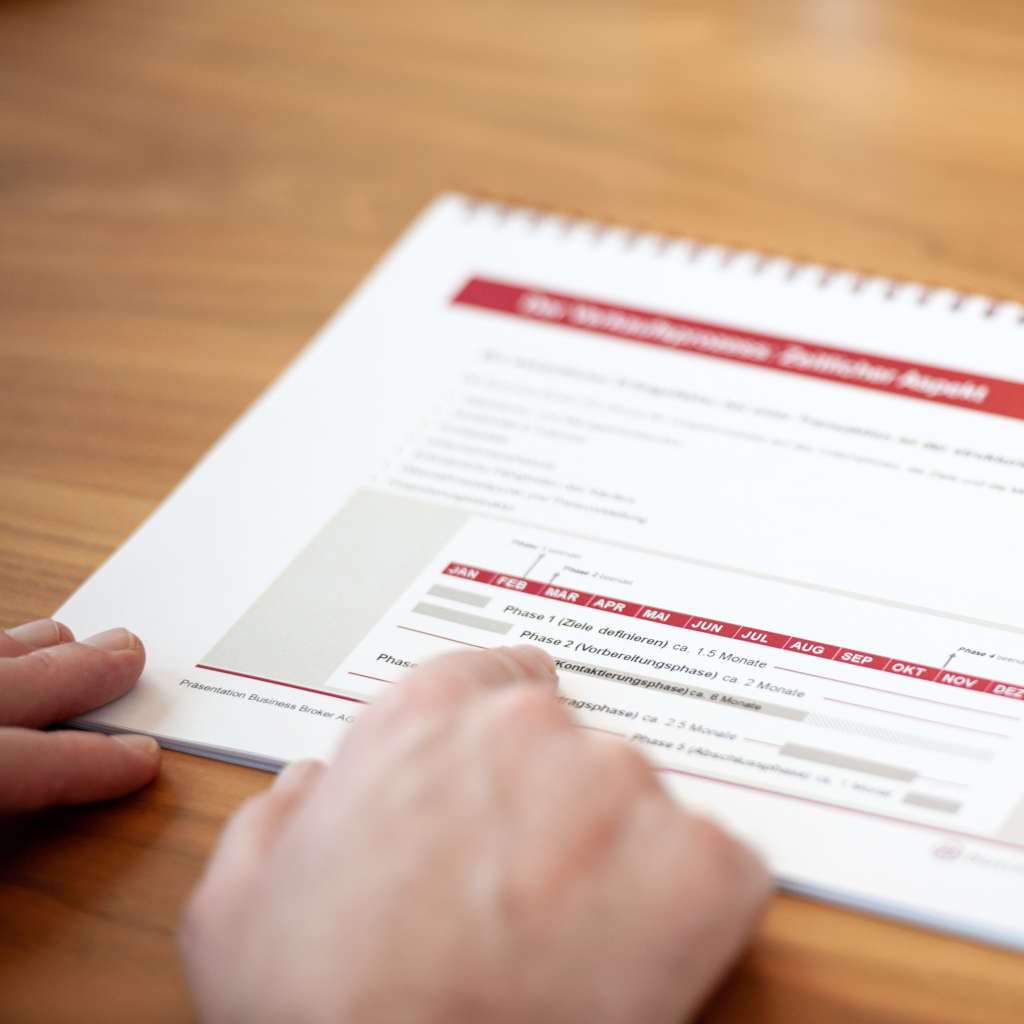

Es werden verschiedene Arten von Due Diligence unterschieden (zum Beispiel Pre Due Diligence, Pre Acquisition Due Diligence, Post Completion Due Diligence, Post Acquisition Due Diligence), welche sich je nach dem Zeitpunkt der Durchführung und der Zielsetzung unterscheiden. Bei einem Unternehmensverkauf findet die Due Diligence üblicherweise nach der Annahme eines unverbindlichen Angebots (Letter of Intent) durch den Käufer statt. Zu diesem Zeitpunkt sind sich Käufer und Verkäufer über die grundlegenden Konditionen einig. Die Konditionen werden nach erfolgter Due Diligence Prüfung bestätigt bzw. angepasst und schriftlich festgehalten und dienen als Basis für die Ausarbeitung der Kaufverträge. Erst mit der Unterzeichnung der Vertragswerke wird der Firmenverkauf rechtlich verbindlich.

Für die Durchführung der Due Diligence richtet der Verkäufer oder dessen Berater einen Datenraum ein, in welchem die notwendigen Dokumente und Informationen zur Verfügung gestellt werden. Der Datenraum kann physisch oder virtuell organisiert werden.

Während der Due Diligence-Phase wird eine systematische und transparente Kommunikation besonders wichtig, damit die umfassenden Informationen zielgerichtet ausgetauscht werden können und entsprechend ihrer Notwendigkeit in den Kaufvertrag (unter Gewährleistungen und Zusicherungen des Verkäufers) einfliessen.